Income For Life

You likely have already insured your home, your vehicle and (hopefully) your life. Did you know you can also insure your retirement income? Combining Social Security with your own “permanent personal pension” is a strategy that allows you to sleep well every night knowing that regardless of any future stock market activity, you can count on a specific, never shrinking income for life.

Using our A-B-C template, we work together to reveal how every dollar falls into one of three categories. One of those categories should provide lifetime income…similar to Social Security. We can work together to determine your expected permanent expenses in retirement and then design an income for life strategy to meet those expenses. The monies not allocated to that portion of the A-B-C strategy will be available for non-essentials such as stock market trading, travel, hobbies, or helping family members if necessary.

Maximizing Social Security benefits is another very important item we help our clients with. Do you know that there are about 567 different ways to collect Social Security? According to the Social Security Administration, about 90% of people leave money on the table when making their Social Security election. Also, in many cases Social Security benefits are subject to income tax. Part of maximizing benefits is understanding taxes and different selection strategies. For the most part, these are decisions that cannot be reversed or undone and the result of these decisions will have multiple years of impact.

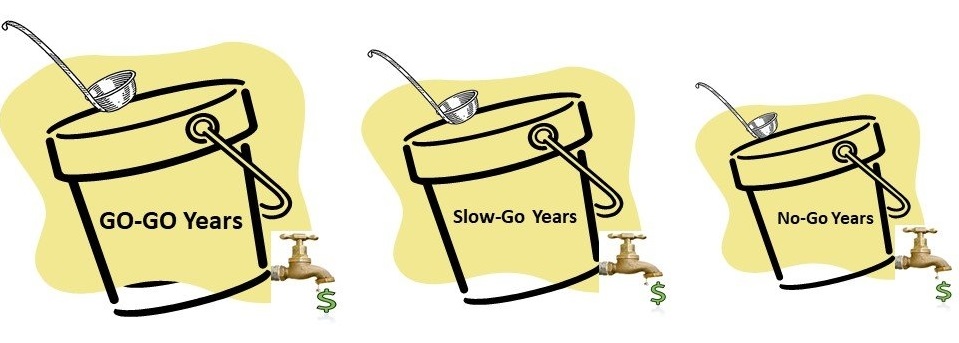

It’s pretty well known that we will be the most active in the first ten years of retirement. This is when there is a lot of pressure on our retirement cash flow. After that things slow a bit and we often actually begin accumulating savings again. Finally in the final years of retirement we slow down and begin to find expensive health care costs taking chunks of money from savings. We can show you how to prepare for that as well.